Chefs love to see a recipe model come together in the final stages. Sole proprietor owners love this stage even more if possible. What's the lure? They see how much it costs to produce the actual menu items with all the trimmings.

The most frequently asked question at this stage goes something like "How do we tell the system our cover costs? Is there a way to enter a Q factor?"

I let them know they should enter all applicable costs to properly cost the menu. The follow up question is actually a lengthy discussion of complimentary items, starch choices depending on the entree choice, most popular options, etc.

I like to create a setup recipe which may be used over and over in every entree selection. My Q factor includes all complimentary items (rolls, butter, ketchup, mustard, soy sauce, salt & pepper, Tabasco sauce, etc.), salad portion, most popular dressing choice, most popular starch choice and the most popular side choice.

The POS system will keep track of the guest selections. If the most popular salad dressing is Blue Cheese and the POS modifier is Ranch, I like to make the recipe for the Ranch modifier equal to 1 portion of Ranch minus 1 portion of Blue Cheese. Since the Q factor already accounted for the Blue Cheese, the reduction of 1 Blue Cheese portion brings the count in line.

What's a typical Q factor in a high end dining room offering rolls, butter, salad, baked potato, more butter, and sour cream? About $3 if you use fresh baked rolls.

Selasa, 21 Juli 2009

Minggu, 19 Juli 2009

Great Article on Managing Food Costs

Brad Nelson, Marriott's Corporate Chef, wrote a great post on his blog last summer when food costs were beginning to spiral high due to the energy crisis. His article focuses on the backyard grilling options for the frugal home cooks.

The chef uses less tender cuts of beef and garden fresh vegetables from his own garden. There's a great recipe for new potatoes which cook in a cast iron skillet over slow coals.

The chef uses less tender cuts of beef and garden fresh vegetables from his own garden. There's a great recipe for new potatoes which cook in a cast iron skillet over slow coals.

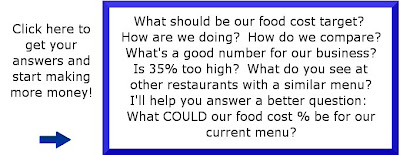

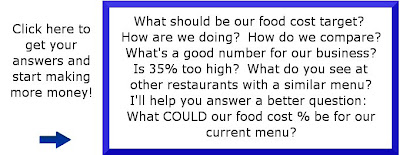

Basic Food Cost Analysis

An investment of time and money in any recipe costing model has a payoff in food cost analysis. Most operators lack sufficient information to conduct a meaningful food cost analysis. Many operators receive a simple percentage which they are told is either too high or too low(occasionally, just right).

If the company's accounts payable system charges all cost of goods sold to the same account, there is no additional information available. So what do these companies focus on when trying to explain their food cost results? Their food cost analysis typically consists of a review of the ending inventory.

This food cost analysis works like this in most cases: 1. Scan the Excel file looking for large inventory totals. 2. Check these high impact numbers for unit cost information. 3. Once a major item is found with some price volatility, the entire analysis ends and management works on "solving the problem". Occasionally, this team may get around to using a top 10 analysis. This is a small step in the right direction.

Often, the food cost analysis completely ignores the true issue. Many food cost "problems" stem from an incorrect inventory value the previous period. No one remembers the over valuation from the previous period. The simple reason this is ignored is the euphoria caused by a great food cost percentage eliminated the need for any proper food cost analysis. This incorrect valuation went completely unnoticed until now.

When I'm called in to help with inconsistent food cost percentages, I find the top 10 items in terms of purchase volume. My work includes tests of everything involving these items. A thorough analysis of the top 10 items is the best place to start any meaningful food cost analysis. Eventually, you will want to increase the list to the Top 25.

Advanced recipe models automatically focus on 10 to 25 items (depending on the menu scope). Knowing the eventual solution will be found in these high impact items can be useful to the operator with limited information.

Treat each item like a stock in a portfolio. Each food cost component has an impact relative to the unit volume, price volatility and risk of spoilage. Focus on perishable, high volume items with volatile market prices. You'll find many solutions in this key item food cost analysis.

If the company's accounts payable system charges all cost of goods sold to the same account, there is no additional information available. So what do these companies focus on when trying to explain their food cost results? Their food cost analysis typically consists of a review of the ending inventory.

This food cost analysis works like this in most cases: 1. Scan the Excel file looking for large inventory totals. 2. Check these high impact numbers for unit cost information. 3. Once a major item is found with some price volatility, the entire analysis ends and management works on "solving the problem". Occasionally, this team may get around to using a top 10 analysis. This is a small step in the right direction.

Often, the food cost analysis completely ignores the true issue. Many food cost "problems" stem from an incorrect inventory value the previous period. No one remembers the over valuation from the previous period. The simple reason this is ignored is the euphoria caused by a great food cost percentage eliminated the need for any proper food cost analysis. This incorrect valuation went completely unnoticed until now.

When I'm called in to help with inconsistent food cost percentages, I find the top 10 items in terms of purchase volume. My work includes tests of everything involving these items. A thorough analysis of the top 10 items is the best place to start any meaningful food cost analysis. Eventually, you will want to increase the list to the Top 25.

Advanced recipe models automatically focus on 10 to 25 items (depending on the menu scope). Knowing the eventual solution will be found in these high impact items can be useful to the operator with limited information.

Treat each item like a stock in a portfolio. Each food cost component has an impact relative to the unit volume, price volatility and risk of spoilage. Focus on perishable, high volume items with volatile market prices. You'll find many solutions in this key item food cost analysis.

Jumat, 17 Juli 2009

Finding Strength In A Weak Economy

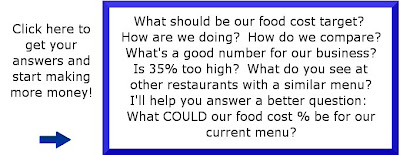

I sent this letter by WinFax Pro around 19 years ago to hundreds of restaurant owners:

Cost Reduction = Profit Improvement

Cost reduction is dirty business. Few managers want to trim fat by eliminating jobs. Cost reduction is not flashy (like sales increases or new openings).

A 10% reduction in costs can increase profit by 25 to 50%. I can help you concentrate the bulk of cost reduction efforts in the areas that affect profit the most. Completion of a short-term strategy can be accomplished in one month.

Where can the greatest savings be realized? Where should you concentrate your efforts? If you aren't aware of where the bulk of your money is going, you can't possibly know in what areas cost reduction will have the greatest impact.

Current economic conditions offer low interest rates and low inflation. This environment encourages borrowing to invest in cost saving solutions. If you could borrow money cheaply to buy a solution which would lower future costs and improve quality, now is your time.

Streamline your organization through a comprehensive cost reduction program. Build profits through cost reduction, as opposed to unit growth. I can help you eliminate short-term debt and replace it with fixed long-term debt, sell off or close down marginally profitable or red ink operations, free up working capital through inventory management.

Cost Reduction = Profit Improvement

Cost reduction is dirty business. Few managers want to trim fat by eliminating jobs. Cost reduction is not flashy (like sales increases or new openings).

A 10% reduction in costs can increase profit by 25 to 50%. I can help you concentrate the bulk of cost reduction efforts in the areas that affect profit the most. Completion of a short-term strategy can be accomplished in one month.

Where can the greatest savings be realized? Where should you concentrate your efforts? If you aren't aware of where the bulk of your money is going, you can't possibly know in what areas cost reduction will have the greatest impact.

Current economic conditions offer low interest rates and low inflation. This environment encourages borrowing to invest in cost saving solutions. If you could borrow money cheaply to buy a solution which would lower future costs and improve quality, now is your time.

Streamline your organization through a comprehensive cost reduction program. Build profits through cost reduction, as opposed to unit growth. I can help you eliminate short-term debt and replace it with fixed long-term debt, sell off or close down marginally profitable or red ink operations, free up working capital through inventory management.

Rabu, 15 Juli 2009

Plate Cost Question

Hello,

I have a question and may-be you can help me. When doing a plate cost for your menu items would you include paper products in with the food cost or would it just be the food products to get an accurate food cost.

Thanks,

Food Service Manager

There is no hard and fast rule regarding inclusion of paper products in a plate cost. I'd recommend you build in all costs when calculating a true gross margin.

Cost of sales should include food, beverages and all supplies which vary directly with a sale of an item. An accurate food cost would include only food purchases and you should only divide the costs by sales of food items.

Senin, 13 Juli 2009

Basic Recipe Costing - Part 3

I started my consulting company in 1990 to help food service operators with financial troubles. Finding it difficult to get paid, I started looking for work with companies in better shape. I ran into a local consultant, Bob Kaiser, who said I should work with computers since I had a background in accounting and technology.

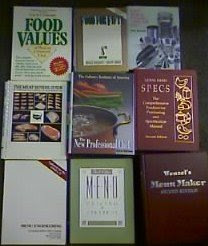

My first assignment was with one of Bob's clients. This company had two catering facilities and used Eatec software. The chef had zero success building recipes despite purchasing the The Professional Chef and the Food for Fifty (12th Edition)

and the Food for Fifty (12th Edition) modules.

modules.

These add on modules were a huge time killer. I found myself gutting sophisticated recipes for chicken, beef and vegetable stocks and replacing the classic recipes with a package of soup base and a gallon of water. After hours of wasted time, I completely destroyed the chef's preliminary efforts and built the recipes from scratch.

I used the Professional Chef book's approach and started with Mise en Place and Stocks. Then I progressed to Soups and Sauces before starting work on entrees. After a week, I had all the major protein work done. The vegetables, starches, breakfast items, baked goods and desserts went much quicker.

During the project, my wife and I began to refer to this gig as "The $4,000 Mistake" since it consumed over 200 hours and 3 round trips (300 miles each trip) to finish.

The Food For Fifty book has a fantastic first chapter which is a must read for anyone trying this exercise for the first time. They focus on quantity food service and use the perspective of a caterer or institutional food service operator. Recipes all yield 50 portions. I took many of the chef's clippings from Bon Appetit and Gourmet and converted them to the 50 portion yield.

Before you start a project on a recipe costing program, you need to be very well organized. Create an outline. Take the most complex recipe and imagine you are building the database. You will find you need to stop work and create other sub-recipes first since you can't purchase many of the stocks, sauces, mixes and blends called for in the recipe. Each of these components requires a recipe.

These individual components called for by the complex recipes are the building blocks of a successful recipe model.

My first assignment was with one of Bob's clients. This company had two catering facilities and used Eatec software. The chef had zero success building recipes despite purchasing the The Professional Chef

These add on modules were a huge time killer. I found myself gutting sophisticated recipes for chicken, beef and vegetable stocks and replacing the classic recipes with a package of soup base and a gallon of water. After hours of wasted time, I completely destroyed the chef's preliminary efforts and built the recipes from scratch.

I used the Professional Chef book's approach and started with Mise en Place and Stocks. Then I progressed to Soups and Sauces before starting work on entrees. After a week, I had all the major protein work done. The vegetables, starches, breakfast items, baked goods and desserts went much quicker.

During the project, my wife and I began to refer to this gig as "The $4,000 Mistake" since it consumed over 200 hours and 3 round trips (300 miles each trip) to finish.

The Food For Fifty book has a fantastic first chapter which is a must read for anyone trying this exercise for the first time. They focus on quantity food service and use the perspective of a caterer or institutional food service operator. Recipes all yield 50 portions. I took many of the chef's clippings from Bon Appetit and Gourmet and converted them to the 50 portion yield.

Before you start a project on a recipe costing program, you need to be very well organized. Create an outline. Take the most complex recipe and imagine you are building the database. You will find you need to stop work and create other sub-recipes first since you can't purchase many of the stocks, sauces, mixes and blends called for in the recipe. Each of these components requires a recipe.

These individual components called for by the complex recipes are the building blocks of a successful recipe model.

Taking Stock

No one likes doing stocktakes. However, an accurate stock count is essential to producing meaningful management information.

Here are some tips on doing an accurate stocktake:

Have a hard copy of your stock list - A list grouping stock items by Category, then listing Stock Items in alphabetical order makes it relatively easy to look-up Stock Items as you count.

Do one storeroom at a time - If you have stock items that are stored in multiple locations (dry store, cool room and service fridges), don't run around the kitchen to find all instances. Count methodically through one store location at a time.

Count each storage location left to right, top to bottom - Start at the top left of each shelf, then work your way down to the bottom right. That way you wont miss anything.

Count with a friend - It is faster and easier if you count in pairs. One person can physically count the stock while the other records the counts. In addition to speeding up the process this also serves as a check, to make sure you don't miss anything.

Although counting stock may seem simple, it is surprising how many people I have seen get it wrong.

Paul Clarke (@foodmargin)

Jumat, 10 Juli 2009

An Opportunity With A Tight Budget

Good Day Mr Dunbar!

I'm seeking answers & asking for your help with food cost & menu engineering.

Info in hand: I put up my own cafeteria inside a factory; catering to 80+ people. I'm a BS Hotel& Restaurant Mgt graduate - 2005; can not remember much about Food Costing. The net only gives guides & lacks experience that's where I'll need your expertise sir.

They also allotted only 2 dollars for food allowance; the employee must eat at least 1 meal(breakfast,lunch or dinner) & 1 snack. How can I manage & even start w/ this.

Thank you in advance for the time & opportunity!

God Bless!

Gabo

If you are fully reimbursed for labor and all other expenses (including profit), it would be possible to offer a menu with lots of eggs, poultry, starches, seasonal vegetables and tea given the allotment. You won't be able to offer any higher cost protein items. The labor issue is key. You'll need to make soups and other labor intensive menu items to meet your goals.

Try to focus on quality as much as possible. Keep accurate records.

After 90 days, ask for a meeting with your client. Try to negotiate a change order. If they enjoy your menu and find you honest and fair, you may be able to suggest some other higher cost ingredients.

What Should Our Bar Cost Be?

Hi Joe

What would you say my expectations for beverage cogs should be in a private club, not a member owned club?

Beer

Wine

Liquor

Thanks for your input, I’m trying to do an analysis and I need some solid guidelines on what it should be.

Sharon│Controller

Sharon,

A well controlled bar is a great source of profit. Many bar operators are out of control and the result over time is unnecessary selling price increases. Alcoholic beverages are highly regulated and the customers order specific brands. This makes for relatively stable costs (usually change quarterly) and no specification issues.

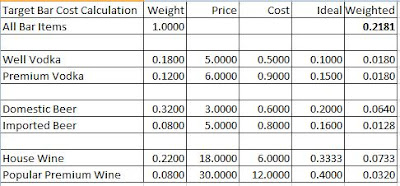

[Feel free to download this simple tool on my Food Cost Control Library site.]

I like to track a simple weighted average figure rather than a hypothetical benchmark. Depending on the level of service, occupancy costs and other factors beyond the cost of alcoholic beverages, your selling price will vary. Sales need to cover all costs and provide a profit (even if your goal is break even at the club, you should budget for risk and cover slightly more than your costs).

Using a weighted average, you should track a handful of key bar items: well vodka drink, premium vodka drink, domestic beer, imported (or micro-brew) beer, house wine and premium wine. Weight each item by the respective sales impact. Sales for all well pours for the well vodka, sales for all premium liquor for the premium vodka, sales for all domestic beers, sales for all premium beers, sales for all house wines and sales for all premium wines.

You simply enter the selling prices and cost of the alcoholic beverages. The Weight column should total 100% or use your total sales. The Ideal column equals the cost divided by the selling price. The Weighted column will supply the answer to your question. This column weights each Ideal figure based on the share of sales for the category.

Feel free to add more categories. The weights should always equal 100% of sales. Guard against going into too much detail. We are not trying to solve every issue with the formula. You will find the current bar cost percentage is higher than the formula result. Resist requests to complicate the formula. Leave all non-alcoholic items out of the pouring cost.

I have found numerous bar operations with major problems (theft, over-pouring, wasting draft beer, lost revenue, etc.) splitting the atom over lemon wedges, olives, and wine sent to the kitchen. Create a separate line item to track the non-alcoholic beverage activity and kitchen wine, liquor and beer.

Accounting Gets Closer To The Kitchen

This month, I noticed an urgency in 3 restaurant chains which would be out of the question in the past. Top level financial officers have made the dive into inventory control including batch recipe models for work in progress inventory. Calling late at night, I found the CFO of a 35 unit chain in the office working feverishly to get the new database deployed. She was working on recipe costing and linking her recipes to the POS system.

Years ago, restaurant companies needed to be shoved into software systems to get better a handle on their cost of sales. Now, these solutions are ubiquitous. POS vendors throw them in for free to sweeten an offer. Solutions exist in every price range.

I spoke with the Executive Chef of a 6 unit group here in the DC Metro area. He was working on a solution with his brother who works in the accounting department. Each of their concepts has a unique menu and they have finished the first test. Results have exceeded their expectations. The actual food cost has now come down to less than 1% above ideal.

Recessions often force corporate staff to wear different hats.

As these financial people work closely with the chefs, purchasing agents and other key operations people, the reports have to improve. Communications are more focused and everyone has a feel for their counterpart's unique issues.

Years ago, restaurant companies needed to be shoved into software systems to get better a handle on their cost of sales. Now, these solutions are ubiquitous. POS vendors throw them in for free to sweeten an offer. Solutions exist in every price range.

I spoke with the Executive Chef of a 6 unit group here in the DC Metro area. He was working on a solution with his brother who works in the accounting department. Each of their concepts has a unique menu and they have finished the first test. Results have exceeded their expectations. The actual food cost has now come down to less than 1% above ideal.

Recessions often force corporate staff to wear different hats.

As these financial people work closely with the chefs, purchasing agents and other key operations people, the reports have to improve. Communications are more focused and everyone has a feel for their counterpart's unique issues.

Kamis, 09 Juli 2009

5 Tips for Receiving Stock

1. Did you get what you paid for?

The first and most obvious tip is to check that you get everything you paid for. Often this is as simple as doing a quick count and checking items off against the delivery note or invoice.

While this seems obvious, take a look at your practices and you will be amazed at how often stock is received without checking it’s all there. Paying for stock you didn’t receive directly impacts your food margin.

2. Do a Quality Check

Make sure the stock you receive meets your expectations. Quality assessment can be made by visually inspection, feeling, smelling and/or tasting ingredients. Inspecting packaging for damages and checking “use-by” dates also ensure you get what you pay for.

Stock that is poor quality will impact the quality of the end product you present to your customer. Poor quality goods may also spoil faster, generating waste and eroding your profitability.

3. Reject Goods that don’t Measure-up

Rejecting stock that doesn’t measure-up communicates your quality expectations to your suppliers, setting the base-line for future transactions.

4. Minimize the time goods spend on the Loading Dock

Ensuring stock is put away promptly increases the life of perishables and reduces the likelihood of theft.

5. Did you get everything you ordered?

Often you need to know ASAP if an ingredient that was ordered didn’t arrive so that you can make alternative arrangements.

Paul Clarke (@foodmargin)

New York Times Features Butchers

This week, the New York Times featured butchers in an article Young Idols With Cleavers Rule The Stage just when everyone thought butchering was a dying art. They interview young butchers from around the country working primarily in boutique butcher shops.

Basic Recipe Costing - Part 2

After you have your item list broken down into purchase units (e.g. case) and inventory units (e.g. #10 can), you can begin to visualize the production process. For each ingredient, make a list of units commonly called in recipes. This will vary depending on how many different recipes use each item.

Three common portion methods for recipe ingredients are weight, volume and count. Meat items are often portioned by weight and count. When portioning by the piece, you may have more than one portion size. A strip steak could be sold in two or three portion sizes. For each portion size, imagine the entire strip will be used. You need to answer a simple question. How many steaks would you expect if you only cut the one size from the strip? Repeat the exercise for each portion size.

Use the average weight for popular random weight items. Generally, each case will always have the same number of large cuts (ribs, strips, loins, etc.). The total case weight will vary. Huge weight variances from the average will impact the number of portions per piece. It helps to keep accurate records of the butchering and fabrication process.

Yields may change from week to week. If you expected a 80% yield for a particular cut and you actually hit a 70% figure, your costs would run higher by over 11%. The variance is due to the poor yield alone. Add a price variance and some spoilage and the gross margin will begin to disappear. Portion control steaks provide operators with a consistent yield - one portion. When deciding to purchase portion control meat, you need to consider the hidden costs. Look at the whole picture including labor, equipment, risk of injury, and poor yield in your comparison.

Items portioned by volume or weight are straight forward. It is helpful to know the common conversion units for each method. Volume is expressed in gallons, quarts, pints, cups, liters, fluid ounces, milliliters, shots, tablespoons, teaspoons and fractions of each. Weight may be expressed in pounds, ounces, kilograms, grams, etc. A #10 can has about 6 pints (96 fluid ounces) and often about 6 pounds. Check all weight to volume relationships.

When developing standards, you may find your specifications are different than some of the excellent books. If you trim your produce quickly, the yield will probably be lower than the expectation. One way to reduce the variance is to portion produce items by the piece. A 24 head case of iceberg lettuce will yield 144 wedges if sliced in six pieces per head. Cutting the heads into larger wedges of four per head would yield only 96 portions.

Think of this step as the recipe model equivalent of the prep process. Having accurate recipe costs depends on accurate unit and yield data. The recipe costing programs will re-cost your recipes over and over as prices change. Spend the time initially to get this critical information correct for your operation. Don't worry about benchmarks for portion size. Use your unique portion sizes in determining the conversions between inventory count units and the units called for in recipes.

Three common portion methods for recipe ingredients are weight, volume and count. Meat items are often portioned by weight and count. When portioning by the piece, you may have more than one portion size. A strip steak could be sold in two or three portion sizes. For each portion size, imagine the entire strip will be used. You need to answer a simple question. How many steaks would you expect if you only cut the one size from the strip? Repeat the exercise for each portion size.

Use the average weight for popular random weight items. Generally, each case will always have the same number of large cuts (ribs, strips, loins, etc.). The total case weight will vary. Huge weight variances from the average will impact the number of portions per piece. It helps to keep accurate records of the butchering and fabrication process.

Yields may change from week to week. If you expected a 80% yield for a particular cut and you actually hit a 70% figure, your costs would run higher by over 11%. The variance is due to the poor yield alone. Add a price variance and some spoilage and the gross margin will begin to disappear. Portion control steaks provide operators with a consistent yield - one portion. When deciding to purchase portion control meat, you need to consider the hidden costs. Look at the whole picture including labor, equipment, risk of injury, and poor yield in your comparison.

Items portioned by volume or weight are straight forward. It is helpful to know the common conversion units for each method. Volume is expressed in gallons, quarts, pints, cups, liters, fluid ounces, milliliters, shots, tablespoons, teaspoons and fractions of each. Weight may be expressed in pounds, ounces, kilograms, grams, etc. A #10 can has about 6 pints (96 fluid ounces) and often about 6 pounds. Check all weight to volume relationships.

When developing standards, you may find your specifications are different than some of the excellent books. If you trim your produce quickly, the yield will probably be lower than the expectation. One way to reduce the variance is to portion produce items by the piece. A 24 head case of iceberg lettuce will yield 144 wedges if sliced in six pieces per head. Cutting the heads into larger wedges of four per head would yield only 96 portions.

Think of this step as the recipe model equivalent of the prep process. Having accurate recipe costs depends on accurate unit and yield data. The recipe costing programs will re-cost your recipes over and over as prices change. Spend the time initially to get this critical information correct for your operation. Don't worry about benchmarks for portion size. Use your unique portion sizes in determining the conversions between inventory count units and the units called for in recipes.

Rabu, 08 Juli 2009

Food Cost Control Alliance

I would like to introduce my colleague from Australia, Paul Clarke, who will be posting here on the Food Cost Control Blog. Paul has his own blog, Food Margin which offers a "dialog on food operation management" with an impressive start. Food Margin is one month old today.

Selasa, 07 Juli 2009

Recipe Costing Technique - Plate Cost

Hi Joe.

I hope im posting this in the correct blog.

In order to cover our waste, free bread, staff food, and complimentary items we are planning to add a plate cost to our new recipes to cover these costs. We understand that this will push our selling prices up. My question is as follows:

Do we add the plate cost to the recipe or do we simply raise the selling price by the respective plate cost?

Ray

From a strategic viewpoint, there are many options for menu price revisions. The correct overall solution would need to take other factors into consideration.

I prefer to add the plate cost as a fixed number(vs. a percentage)for each entree. This is a preference not an absolute. Some operations will be better off taking a different approach.

The fixed dollar method will also cover your costs regardless of the entree selling price. You'll receive the same cost coverage whether the selling price is $9.99 or $29.99. This is especially attractive now as consumers are choosing lower priced menu items.

Generally, any amount you add to a selling price as a fixed dollar amount is 100% variable from a cost accounting perspective. As you sell units (in our case entrees), the revenue (and variable cost coverage ) are in sync making your break even point more predictable.

Many companies provide complimentary items and do not provide for these costs in their selling prices. With consumers looking for value, you need to consider competitive threats when you evaluate any price increase decision.

Rabu, 01 Juli 2009

Basic Recipe Costing - Part1

You may have lots of cookbooks, proprietary recipes, books with food yield statistics, market data, shopping lists, inventory count sheets, supplier quotes, product mix reports, quarterly tracking reports and other documents. A professional recipe model should be designed to integrate all of this useful information. The person working on this project needs to wear many hats: purchasing agent, steward, prep cook, line cook, and chef.

Rather than using a cookbook approach, start with your shopping lists. Use your shopping lists to create a spreadsheet with all your ingredients. Make columns for the name, category, primary supplier, purchase unit, storage area and storage unit.

Since the unit you purchase is used on orders, this is our starting point. It's helpful to know your alternate sources for each ingredient. You may want to categorize each item by the storage method. For example, frozen, refrigerated, dry bulk, canned goods, frozen goods, baked goods, etc. Feel free to add these columns. Its impossible to get too much information for your ingredient list.

[We'll eventually need to know the usage units for each ingredient and portion information. This will be discussed in Part2 (later this month).]

Once the list begins to come together, envision the flow for each item from loading dock to the table. Most items are purchased by the case and are stored as purchased. Some items are immediately transformed into other items through fabrication. Visualize the process of moving from the purchased unit of measure to the storage unit of measure first.

You may simply remove six #10 cans from a case and place the cans in a rack. The purchase unit is case and the storage unit is a #10 can. Focus on the storage unit and the divisor (6 in our example). Breaking down every item you purchase into logical storage units is one of the most important steps in creating a professional recipe costing model.

Each #10 can is valued at 1/6 of the case cost. Don't worry about the actual cost of each can. Focus on the number of storage units in each purchase unit.

Our work will eventually involve many calculations using units of measure, various blends, yield formulas, conversions, reciprocals and standard portion data. The simple exercise of developing a purchase unit to storage unit model is the ideal starting point. Once you complete this exercise, future conversion work will be more intuitive.

Rather than using a cookbook approach, start with your shopping lists. Use your shopping lists to create a spreadsheet with all your ingredients. Make columns for the name, category, primary supplier, purchase unit, storage area and storage unit.

Since the unit you purchase is used on orders, this is our starting point. It's helpful to know your alternate sources for each ingredient. You may want to categorize each item by the storage method. For example, frozen, refrigerated, dry bulk, canned goods, frozen goods, baked goods, etc. Feel free to add these columns. Its impossible to get too much information for your ingredient list.

[We'll eventually need to know the usage units for each ingredient and portion information. This will be discussed in Part2 (later this month).]

Once the list begins to come together, envision the flow for each item from loading dock to the table. Most items are purchased by the case and are stored as purchased. Some items are immediately transformed into other items through fabrication. Visualize the process of moving from the purchased unit of measure to the storage unit of measure first.

You may simply remove six #10 cans from a case and place the cans in a rack. The purchase unit is case and the storage unit is a #10 can. Focus on the storage unit and the divisor (6 in our example). Breaking down every item you purchase into logical storage units is one of the most important steps in creating a professional recipe costing model.

Each #10 can is valued at 1/6 of the case cost. Don't worry about the actual cost of each can. Focus on the number of storage units in each purchase unit.

Our work will eventually involve many calculations using units of measure, various blends, yield formulas, conversions, reciprocals and standard portion data. The simple exercise of developing a purchase unit to storage unit model is the ideal starting point. Once you complete this exercise, future conversion work will be more intuitive.

Langganan:

Komentar (Atom)