Mary Molt's classic catering book Food for Fifty (12th Edition)

You can also get yield information on meat from the must have industry standard. The NAMP's The Meat Buyers Guide : Meat, Lamb, Veal, Pork and Poultry

Joe

I am a big fan of your food cost control blog and was wondering if you would be able to help me with 3 questions.

How do you account for the difference in cost come inventory time for product pre-yield and post-yield. For example, you have to account for the cost of uncooked rib roast which costs you lets say $5/Pound. So in your freezer you have 1# of precooked rib roast or $5 worth of product. You also have 1# of cooked rib roast. The cooked rib roast is obviously the product of the uncooked rib roast after a 20% shrink. Therefore, 1# of cooked rib roast really costs you $6.25.

How do you account for the difference in cost on your inventory sheets to get an accurate ending inventory value. Do you have 2 line items, precooked rib roast at a value of $5 per pound and cooked rib roast at a cost of $6.25 per pound?

Also, with the large number of items that you do not get a 100% yield on such as rib roast, how do you know the sum of the legitimate shrink? For example, you take all of your recipe costs times your product mix sales report and you theoretically ran a 28% food cost, but your physical inventories show a 31% food cost. How do you know how much of the 3 % difference was legitimate shrink?

Commissary? When you have 7 restaurants running a commissary where 90% of the food is made out of one location, what is the best way to set it up? Do you set it up as a separate business and sell each restaurant the product with the labor and other expenses wrapped in to the product to cover your overhead and break even or do you sell the restaurants the product at its actual cost and then divide the entire overhead of the commissary operation between all of the units equally? Or is there another way that a commissary should be run?

Does this all make sense? I have scoured the web and have come up empty.

Thanks,

Josh

Dear Sir

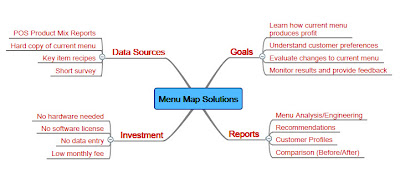

I need To know the classification of items in menu engineering (like cash cow)

but I don't know the others. Please send me the others and the explanations.

Cost Controller (major 4 star hotel)

Good morning Mr. Dunbar.

I often hear F&B managers talking about budgeting and forecasting. What is the difference between the two and how would you budget and forecast an operation?

Regards

Robert